Employee Achievement Awards: What You Need to Know About Tax-Free Recognition

Unlock tax-free employee achievement awards! Learn IRS rules, avoid pitfalls, and boost morale with compliant recognition.

Why Getting Employee Achievement Awards Right Matters for Your Bottom Line

Employee achievement awards are a powerful tool for recognizing your team's hard work. When done right, they offer a tax-free way to celebrate milestones like length of service or safety achievements. However, navigating the IRS rules can be a minefield.

Consider this: only 19% of employees receive weekly recognition, and over half feel acknowledged only a few times a year. You want to change that, but questions about tax compliance can be a major roadblock. Is a gift card taxable? What's the limit for a service award? Getting it wrong can lead to unexpected taxes for your employees and penalties for your company.

The good news is that a well-structured program is a win-win. Your company gets a tax deduction, your employees receive a tax-free award, and your culture gets a boost from meaningful appreciation. This guide will show you how to steer the complexities and create a program that works.

I'm Meghan Calhoun, Co-Founder of Give River. With over two decades of experience building high-performing teams, I've seen how strategic recognition can transform a workplace—and how easily tax mistakes can undermine good intentions. Let's break down what you need to know to create an awards program that satisfies both the IRS and your team.

The Ultimate Guide to Tax-Compliant Employee Achievement Awards

Navigating the rules for employee achievement awards is key to creating a program that rewards your team without creating tax headaches. Let's break down the IRS regulations.

What is a Tax-Free Employee Achievement Award According to the IRS?

The IRS defines an employee achievement award as "an item of tangible personal property transferred by an employer to an employee for length of service achievement or safety achievement, awarded as part of a meaningful presentation, and awarded under conditions that do not create a significant likelihood of disguised compensation."

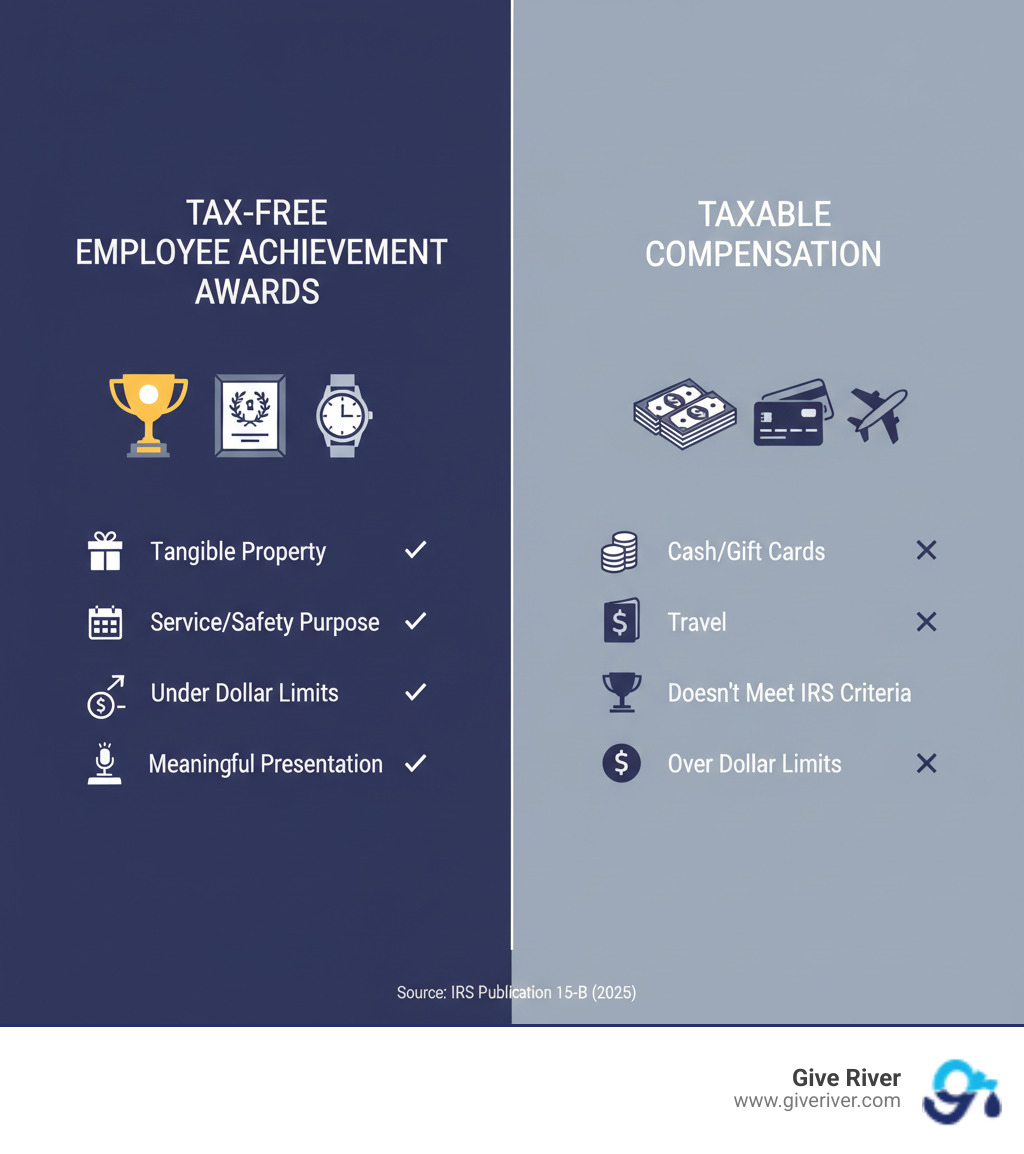

This definition establishes four core requirements:

- It must be tangible personal property (a physical item).

- It must be for length of service or safety achievements under specific conditions.

- It requires a meaningful presentation to acknowledge the achievement.

- It cannot be disguised compensation meant to replace regular pay.

When these conditions are met, the employer can deduct the cost, and the employee receives the award tax-free.

Tangible Property vs. Taxable Cash Equivalents

The "tangible personal property" rule is a common point of confusion. Here’s what qualifies and what doesn’t.

Qualifying Tangible Property:These are physical items. Think of:

- Watches, clocks, or jewelry

- Plaques or trophies

- Electronics or small appliances (within value limits)

- Branded company merchandise

Non-Qualifying (Taxable) Items:Anything that acts like cash is considered taxable income for the employee. This includes:

- Cash

- Gift cards and gift certificates

- Travel, vacations, or event tickets

- Stocks, bonds, or other securities

If an award is not tangible personal property, its full value is treated as wages, subject to income and payroll taxes.

Navigating the Specifics of Service and Safety Awards

To be tax-free, an employee achievement award must recognize either length of service or safety, and each has strict rules.

Length of Service Awards

- 5-Year Rule: An employee cannot receive a service award within their first five years of employment.

- Frequency Limit: An employee cannot have received another service award in the same year or the previous four years. This effectively limits tax-free service awards to 5-year, 10-year, 15-year anniversaries, and so on.

Safety Achievement Awards

- Eligible Employees: Awards cannot be given to managers, administrators, clerical staff, or other professional employees. They are intended for employees whose roles directly impact safety.

- 10% Rule: In a given year, safety awards can only be given to 10% or fewer of your eligible employees. Once you exceed this limit, any further awards become taxable.

Understanding the Dollar Limits for Employee Achievement Awards

Even if an award meets all other criteria, its value determines its tax treatment. The limits depend on whether you have a "qualified" or "non-qualified" plan.

| Feature | Non-Qualified Plan | Qualified Plan |

|---|---|---|

| Deductible Limit (Employer) | Up to $400 per employee, per year. | Up to $1,600 per employee, per year. |

| Tax-Free Limit (Employee) | Up to $400 per employee, per year. | Up to $1,600 per employee, per year. |

| Average Cost Limit | N/A | The average cost of all awards under the plan cannot exceed $400. |

A qualified plan is a formal, written program that does not discriminate in favor of highly compensated employees. While it allows for individual awards up to $1,600, the average cost of all awards given under the plan for the year must not exceed $400. This prevents companies from giving a few large awards while neglecting broader recognition.

Avoiding Common Pitfalls: Disguised Compensation and FLSA Rules

The IRS scrutinizes awards to ensure they aren't "disguised compensation"—a way to pay employees while avoiding taxes. An award may be considered disguised compensation if it's given alongside salary reviews or as a substitute for a regular cash bonus. The key is that the award must genuinely celebrate an achievement, not supplement regular pay.

The Fair Labor Standards Act (FLSA)

Beyond taxes, the Fair Labor Standards Act (FLSA) can impact your awards program, especially for safety incentives. If a safety award is considered "remuneration," its value must be included in an employee's regular rate of pay when calculating overtime. This can lead to unexpected back-pay liabilities. For example, a cash prize for a perfect safety record could trigger this requirement. For more details, you can refer to the official guidance on the Fair Labor Standards Act (FLSA).

To avoid this, it's crucial to structure safety programs carefully. While there are no specific exceptions for small businesses, all companies must follow these rules. Consulting with a tax or legal professional is always the best way to ensure your program is compliant.

Conclusion: Build a Recognition Program That Works

From Compliance to Culture: Making Your Employee Achievement Awards Matter

Understanding the rules for employee achievement awards—from tangible property to dollar limits—is the first step. But a successful program is about more than just compliance; it's about building a culture where employees feel genuinely valued.

More than half of employees feel recognized only a few times a year. A formal, written recognition policy ensures fairness and transparency, turning awards into meaningful moments. The IRS requirement for a "meaningful presentation" is a reminder that the story behind the award is just as important as the award itself. It’s your chance to connect an individual's contribution to the company's mission.

While tax-advantaged awards are powerful, they are just one part of a complete recognition strategy. Platforms like Bonusly or Kudos, for example, excel at facilitating peer-to-peer shoutouts. Give River builds on this by offering a more holistic approach. While other platforms focus primarily on social praise, our 5G Method combines recognition with wellness, professional growth, gamification, and community impact. We help you create a comprehensive environment where celebrating achievements, supporting well-being, and giving back are all part of the same positive feedback loop.

Imagine a workplace where every contribution is seen and celebrated. That’s not just good for morale—it’s good for your bottom line. You've taken the time to learn the rules; now it's time to build a program that transforms your company culture.

Ready to build a culture of recognition that works? We're here to help.